Too often, though, they're stuck paying unanticipated funeral bills. It can be especially helpful for individuals who are older and wouldn’t qualify for or be able to afford traditional life insurance.After losing a loved one, family members want to celebrate their life and support one another through the grieving process. Individuals who have prepaid their funeral expenses also usually don’t need final expense insurance.īut individuals who don’t have other coverage or prepaid arrangements can provide for their loved ones with this type of insurance. If they already have a life insurance policy, for example, a small portion of that death benefit can go to cover these expenses. If an individual has already established a way to pay for their end-of-life costs, they generally don’t need final expense insurance. The beneficiaries could use it to pay off debts, to cover the cost of grief counseling, or even take a vacation. While called final expense insurance, once distributed, the claim money becomes cash. In fact, the policy beneficiaries can use the death benefit however they want. It can also be used for any end-of-life expenses, like final medical bills. It can help with cremation or burial, flowers for the funeral, and more. Once paid, they can use that money however they see fit. Once coverage is in place, when the insured passes away, their beneficiaries file a claim with the life insurance provider to be paid the policy’s death benefit. As a result, even people in poorer health can usually qualify for these policies. That means the insured doesn’t need to sit for a medical exam.

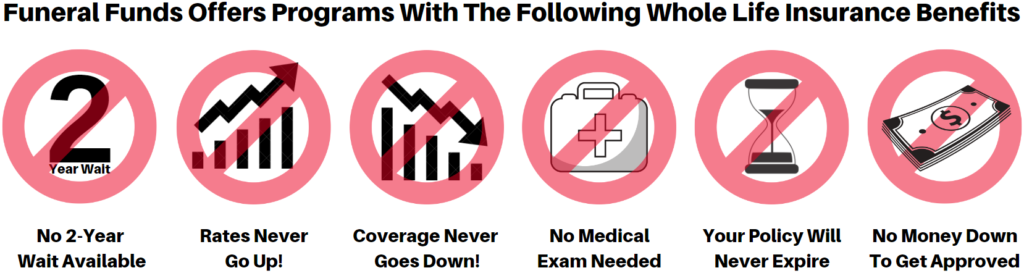

Most final expense insurance is simplified issue coverage. It can be a solution for people unable to afford the premiums of other types of life insurance policies. That means it will last the insured’s lifetime with fixed premiums and most likely includes a cash value component, although that will be small because of the limited policy size.Īdditionally, because of its smaller death benefit, final expense insurance may be more affordable than traditional life insurance.

Generally, final expense insurance is a type of whole life insurance policy. With it, the policy owner can rest easy knowing the beneficiaries they name will have sufficient funds to cover expenses that arise at the end of their life. It’s designed specifically to cover end-of-life expenses for the policy owner’s beneficiaries. The National Funeral Directors Association (NFDA) says that the median cost of a funeral with a viewing and a burial rings in at more than $7,500.įinal expense insurance comes with a smaller death benefit than other types of life insurance, usually between a few thousand and $50,000. But that could mean leaving their family with an expected financial burden at a time that’s already emotionally trying. Many people underestimate the cost of final expenses until faced with the price tag. Covering the expense of funeral proceedings Final expense insurance is a type of life insurance with a small death benefit designed to pay for burial or cremation, funeral expenses, and any other end-of-life costs.

0 kommentar(er)

0 kommentar(er)